Foreign companies willing to perform business in the largest state in the Baltic region may open a form of business called a branch office.

Although the permission for many actions must be received from the parent company, many entrepreneurs choose this form of business because of the small costs of registration and administration.

This is given by the fact that the branch office in Lithuania is not an independent entity (it is fully dependent on its parent company) and thus, it must develop the same business operations that the parent company develops.

Below, our company formation agents in Lithuania explain how to set up a branch office in this country.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

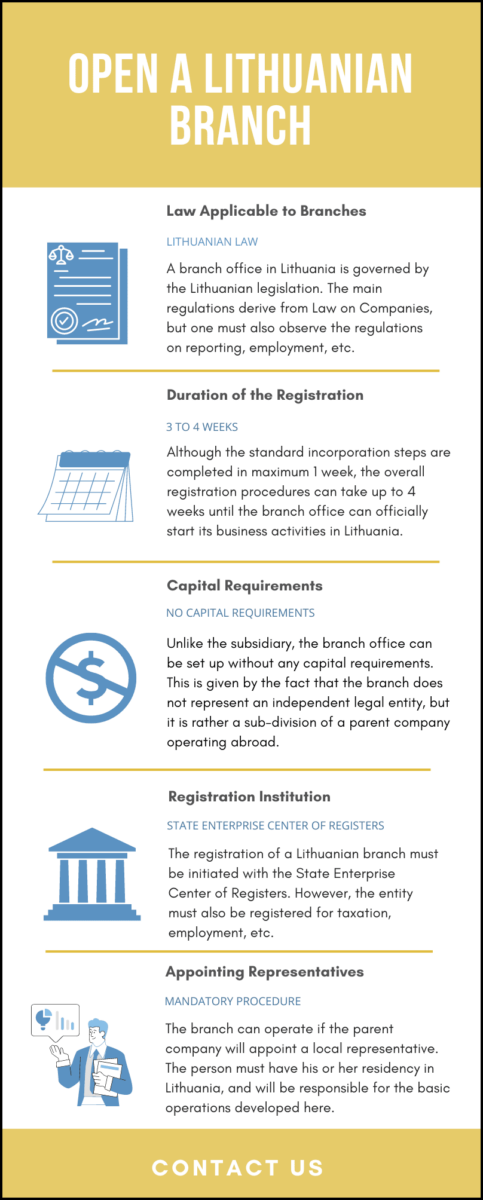

Lithuanian law (Law on Companies of the Republic of Lithuania) |

|

Best Used For |

It is used to develop business activities, following the same business model of the parent company. |

|

Minimum share capital (YES/NO) |

No minimum capital requirements |

| Time frame for the incorporation (approx.) |

3-4 weeks (basic registration procedures are completed in 3-5 business days) |

| Management (Local/Foreign) | The management of the branch is established by the parent company |

| Legal representative required (YES/NO) |

Yes, a local resident representative is necessary |

| Local bank account (YES/NO) |

No |

| Independence from the parent company | It represents a sub-division of the parent company, dependent to the main company. |

| Liability of the parent company | The parent company is fully liable for the branch. |

| Corporate tax rate | Standard corporate tax rate is of 15% (special reduced rates of 0% and 5% are available for small companies). |

| Possibility of hiring local staff (YES/NO) | Yes |

| Documents required for the registration |

Investors can establish a branch in Lithuania by submitting the following documents: – the application form; – the decision to set up a branch, taken by the board of the parent company; – the parent company’s certificate of registration and incorporation documents; – the founding documents of the branch; – the proof of payment of the registration fee; – documents attesting having a registered address in Lithuania. |

|

Institution in charge with the registration |

State Enterprise Center of Registers |

|

Tax registration obligations |

The branch must apply for a tax registration number and a VAT number. |

| Tax reporting |

The branch is liable to the payment of all corporate taxes in Lithuania (but it is taxed only for the income generated in Lithuania, not the company’s global income). As such, it must prepare corporate tax income reports and prepare annual financial statements. |

| Taxes related to operating a branch in Lithuania |

Those who will establish a branch in Lithuania will need to pay the following taxes: – corporate income tax (15%); – withholding taxes on interest, royalties (10%, 15%); – VAT (standard rate 21%); – social security contributions (1.45% to 2.71% paid by the employers); – income tax on salaries (20%). |

| Audit obligations (yes/no) |

No |

| Audit exemptions |

The branch is exempt from audit obligations. |

| When can a branch start its activity? |

The activity of the branch can be initiated after all the registration documents, certificates, permits, are issued and the company has hired employees to carry the basic operations of the business. |

| Fees for company registration for a branch |

EUR 26,57 |

| Tax number required (yes/no) | Yes |

| Accounting legislation applicable to foreign branches |

The Lithuanian Accounting Law |

| Termination of business operations of a branch |

– members’ voluntary liquidation; – creditors’ voluntary liquidation; – mandatory liquidation. |

| Institution in charge with the liquidation of a branch |

– State Enterprise Center of Registers; – State Tax Inspectorate; – Lithuanian courts (for mandatory liquidation); – the liquidators. |

| Notary proceedings (yes/no) |

Yes |

| Ways in which our team can help in registering a branch | Our consultants can help investors establish a branch in Lithuania by preparing the necessary documentation, submitting it with the local institutions, obtaining all certificates, permits and licenses, and opening a corporate bank account. |

Features of the Lithuanian branch office in 2024

A branch established in Lithuania is not considered a legal entity and its assets are not separated from the foreign company’s assets. The full liability for its actions is taken by the parent company. If the parent company is in process of liquidation, the assets of the branch are also subject to seizure.

No permit is necessary before opening a branch but in certain domains, licenses are required, such as in banking, insurance, investments, restaurants, telecommunication, etc. If you want to establish branch offices in another jurisdiction, such as Brazil, we can put you in contact with our local partners.

Steps to register a branch in Lithuania in 2024

Before the registration of a branch in Lithuania, a bank account must be opened (if in the future the branch will perform financial operations) but no minimal capital is requested.

The procedure on opening a company in Lithuania as a branch office has not been recently modified, but investors should know that the Lithuanian Law on Companies was amended at the beginning of 2021, prescribing new regulations for opening bank accounts for local businesses.

Here, investors should know that starting with 2021, companies are also allowed to set up their bank accounts at e-money institutions, not only at commercial banks, as it was the case up until 2021.

One can choose any of the 77 e-money institutions licensed in Lithuania. Also, a representative must be appointed in order to take the daily decisions and connect the branch with the foreign company.

It is also necessary to register the branch office with the Company Registrar – this is a mandatory procedure, imposed for all types of companies that can be set up here. The main difference between the local companies and the branches at registration are the documents submitted.

A branch must submit a standard application which contains the name of the foreign company and its registered address, the proof of existence in the foreign country, the name of the directors and their personal details and the decision of opening a branch.

It is also required to provide the decision of appointing a branch’s representative, the powers owned by this representative, the address of the branch, the passport copies of the representative.

The below-mentioned documents must also be included in the application and must be notarized in the country of origin: the certificate of registration, the foundation deeds and the minute of the meeting where the decision of opening a branch was taken.

In case you need company formation services in another country such as the Philippines, we can put you in contact with our partners.

Things to consider upon the registration of a branch office in Lithuania

The registration procedure of a branch office registered in Lithuania is done following the steps required by the State Enterprise Center of Registers.

Please mind that the institution differentiates between structures which are branch offices and representative offices of companies incorporated in Lithuania, and between those set up by foreign companies.

The process for company formation in Lithuania is similar, but the branch office set up by foreign companies will need to go through more procedures. Regardless, both entities are set up following the regulations of the Civil Code of the Republic of Lithuania (Book Two).

The establishment of the branch office, which is the procedure through which the branch gains legal recognition, is slightly different based on the residency of the parent company. In the case of a branch office set up by a Lithuanian company, only three steps have to be completed.

First, the body that wants to establish the branch (the parent company) adopts the decision to set up a branch in accordance with its governing documents.

Then, the regulations that will govern the branch will be set up by its founders. The last step is to establish a management structure for the branch and to appoint the representative.

For foreign companies wishing to open a branch office, the procedure will follow the same three steps mentioned above, but it will have to go through additional steps, meaning that the branch must be registered with the Registrar of Legal Entities, as a part of the mandatory process of company formation in Lithuania.

Prior to the registration itself, the investors must be sure that they have presented the registration documents with a local notary, who is the sole entity entitled to verify if the documents comply with all the requirements, and that the statuses of the branch office are done in accordance with the law in Lithuania.

Then, the documents will be submitted with the local authorities, along with the required forms (there are different forms to be completed, based on the residency of the parent company and our consultants in company registration in Lithuaniacan present additional information).

Then, the procedure is completed with the payment of the registration fee, which follows a different scheme, depending on the residency of the parent company.

If you want to register a branch office in 2024 which is the branch of a foreign company that will set up business operations in Lithuania, please know that that the fee imposed is different than in the case of the fee charged for the registration of a branch of a local company.

Thus, in 2024, the registration of a branch office of a foreign company will be charged with a fee of EUR 41,75. The same fee is imposed when setting up a representative office for a foreign company.

These are fees charged in 2024 by the State Enterprise Centre of Register, as stipulated on the official website of the institution. For the registration of a branch office or a representative office of a legal entity registered in Lithuania, the fee is EUR 26,57 in 2024.

Below, you can watch a short video regarding the procedure to establish a branch in Lithuania:

Accounting requirements for branch offices in Lithuania

Even if the parent company is liable for the Lithuanian branch office’s debts and obligations, being registered in this country also implies certain accounting requirements for the local legal entity. From an accounting point of view, a branch office in Lithuania must:

- • register for tax and VAT purposes (VAT registration is different for branch offices of EU and non-EU companies);

- • the branch must file monthly VAT returns with the Lithuanian tax authorities;

- • the parent company must submit annual tax returns on behalf of the branch office;

- • all accounting must comply with the regulations applied in the home country of the parent company.

This is necessary because the branch office will be set up for the purpose of developing commercial activities. Also, this structure, as well as the subsidiary, are considered permanent establishments of foreign companies, as they set up an office here on a long-term basis.

Thus, various tax and accounting obligations will arise. Although the branch office is not required to pay the same taxes charged to the subsidiary, there are several tax obligations that are mandatory.

For instance, it is necessary to pay the corporate income tax, but the tax is charged only for the income attributed to the activity carried out in Lithuania.

The branch must also pay the VAT, which is currently charged at a rate of 21%. If the company deals with export activities, refund paid VAT is possible. Our team of consultants in company registration in Lithuania can present what are the steps concerning this procedure.

Thus, if you will set up a branch that carries out business activities that are taxed with the standard VAT rate, you will need to make the necessary formalities for registration and payment of the tax. Mind that Lithuania also applies reduced VAT rates, which, in 2024, are charged at the rates of 9%, 5% and 0%.

Therefore, if you will develop business activities that are charged with these rates, your business will qualify for the payment of these reduced rates. The reduced rates apply for hotel units, cultural events, pharmaceutical products, medical equipment for disabled persons, etc.

If the branch office will hire employees, this will automatically imply the payment of social security taxes. Taxes on dividends are also charged in this country.

Various tax benefits can appear if the foreign company, the parent of the branch office, is a tax resident of a country with which Lithuania has signed an agreement for the avoidance of double taxation.

The tax benefits, tax deductions or exemptions will apply in accordance with the regulations of the respective double tax agreement.

Of course, the branch office must maintain financial documents in accordance with the applicable accounting legislation. Such documents must accurately present the financial situation of the company, its losses, revenues, and any other types of transactions made through the branch.

Although other legal entities operating in this country must also initiate an audit, this is not applicable to a branch office.

However, the branch office must maintain very clear documentation on its situation. Documentation is necessary for the company’s employees as well.

Our consultants in company formation in Lithuania can present the mandatory provisions that must be included in any employment contract.

Please know that the branch office can employ both local and foreign workforce. However, where foreign workforce is involved, additional procedures must be completed.

Most of these requirements refer to the immigration procedures that must be fulfilled before starting any employment activity in this country.

For foreign employees who arrive from third party countries, visa requirements are imposed. Please mind that there is also the possibility to transfer an employee of the parent company working abroad to the new office in Lithuania.

However, there is a requirement concerning the minimum duration of the employment of the person – he or she must have been working in the office of the parent company for a minimum of 6 months prior to applying for a work transfer in Lithuania.

The person will be issued with a temporary residence permit if this requirement is met, along with the other basic requirements. For instance, the person must be the holder of a certificate of completion of tertiary education.

If these basic requirements are met, the person can be transferred to work in the branch office established in Lithuania. However, the duration of the employment can’t last for more than 3 years.

If the foreigner wishes to remain in this country for a period longer than this, other visa options must be explored.

Our consultants in company formation in Lithuania can provide assistance on this subject.

You can rely on our specialists for information on the visa options available for foreign workers, but also on the visa options available for foreign employees who want to open a company in Lithuania, regardless of the legal entity of interest.

What is the data on foreign investments in Lithuania?

Given that branch offices are generally registered by foreign companies, our team of consultants in company registration in Lithuania has decided to present important data on foreign companies and, more exactly, on the level of foreign direct investments concluded by foreign enterprises in this country:

- • according to the Official Statistics Portal, by 31 December 2019, the foreign direct investment (FDI) was of EUR 18,6 billion;

- • this accounted for an increase of 9,5% compared to 2018;

- • the most important investments were concluded in the city of Vilnius, which is the capital of Lithuania (investments per capita here accounted for EUR 16,321);

- • the most important investors of the country were Sweden (EUR 3,110.4 million) and Estonia (EUR 2,764.2 million);

- • the top economic sectors preferred by foreign investors were financial and insurance activities (EUR 4.7 billion) and real estate (EUR 2 billion), data available for the capital region.

Common questions on opening a branch office in Lithuania in 2024

There are few specific questions that commonly appear when investors want to open a company in Lithuania. Due to this, below, we have prepared a set of answers to these very common questions. Foreign companies interested in setting up a branch office in Lithuania usually have the following questions:

The branch office is easier and cheaper to establish than a subsidiary. Also, the parent company will have a greater control over than branch compared to the subsidiary. Although it has similar tax obligations as the ones of the subsidiary, the subsidiary may have to comply with more regulations.

Yes, a legal address is a mandatory requirement for opening a branch office in Lithuania. This is required as a part of the process of company formation in Lithuania for all company types, regardless of the preferences of the investors. Local authorities must be officially notified on the company’s address.

Yes, having a local representative is another requirement for opening a branch office in Lithuania. There are other requirements imposed to local branch offices and this is why we invite you to contact our team of consultants in company registration in Lithuania, who can offer more details on this matter.

No, the law does not impose any minimum amount of money to establish such entity. This is one of the advantages investors can have when opening a company in Lithuania, as for other company types, the capital requirement can apply (and it can vary, based on the selected legal entity).

There is no minimum timeframe for setting up a branch office, as the process depends on how soon the documents related to its registration are ready. If you have any other questions or simply need assistance in setting up a branch office, please contact our company registration advisors in Lithuania.